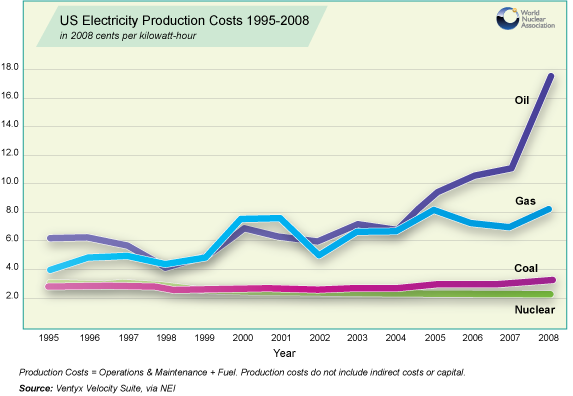

It is important to distinguish between the economics of nuclear plants already in operation and those at the planning stage. Once capital investment costs are effectively “sunk”, existing plants operate at very low costs and are effectively “cash machines”. Their operations and maintenance (O&M) and fuel costs (including used fuel management) are, along with hydropower plants, at the low end of the spectrum and make them very suitable as base-load power suppliers. This is irrespective of whether the investment costs are amortized or depreciated in corporate financial accounts – assuming the forward or marginal costs of operation are below the power price, the plant will operate.

US figures for 2008 published by NEI show the general picture, with nuclear generating power at 1.87 c/kW.

Note: the above data refer to fuel plus operation and maintenance costs only, they exclude capital, since this varies greatly among utilities and states, as well as with the age of the plant.

A Finnish study in 2000 also quantified fuel price sensitivity to electricity costs:

These show that a doubling of fuel prices would result in the electricity cost for nuclear rising about 9%, for coal rising 31% and for gas 66%. Gas prices have since risen significantly.

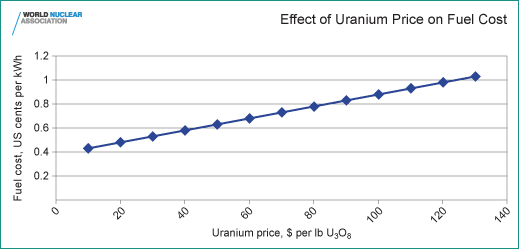

The impact of varying the uranium price in isolation is shown below in a worked example of a typical US plant, assuming no alteration in the tails assay at the enrichment plant.

Doubling the uranium price (say from $25 to $50 per lb U3O8) takes the fuel cost up from 0.50 to 0.62 US cents per kWh, an increase of one quarter, and the expected cost of generation of the best US plants from 1.3 US cents per kWh to 1.42 cents per kWh (an increase of almost 10%). So while there is some impact, it is comparatively minor, especially by comparison with the impact of gas prices on the economics of gas generating plants. In these, 90% of the marginal costs can be fuel. Only if uranium prices rise to above $100 per lb U3O8 ($260 /kgU) and stay there for a prolonged period (which seems very unlikely) will the impact on nuclear generating costs be considerable. *Current exchange rate is 1 U.S. dollar = 3.06449537 Malaysian ringgits.

Nevertheless, for nuclear power plants operating in competitive power markets where it is impossible to pass on any fuel price increases (ie the utility is a price-taker), higher uranium prices will cut corporate profitability. Yet fuel costs have been relatively stable over time – the rise in the world uranium price between 2003 and 2007 added to generation costs, but conversion, enrichment and fuel fabrication costs did not followed the same trend.

For prospective new nuclear plants, the fuel element is even less significant (see below). The typical front end nuclear fuel cost is typically only 15-20% of the total, as opposed to 30-40% for operating nuclear plants.

Source: World Nuclear Association

Organized content is the best way to display or post an article, thank you for making it easy to digest your post.

ReplyDelete----------------------------------

buy writing service